Go to summary

Go to summary

Air and commercial activities hindered

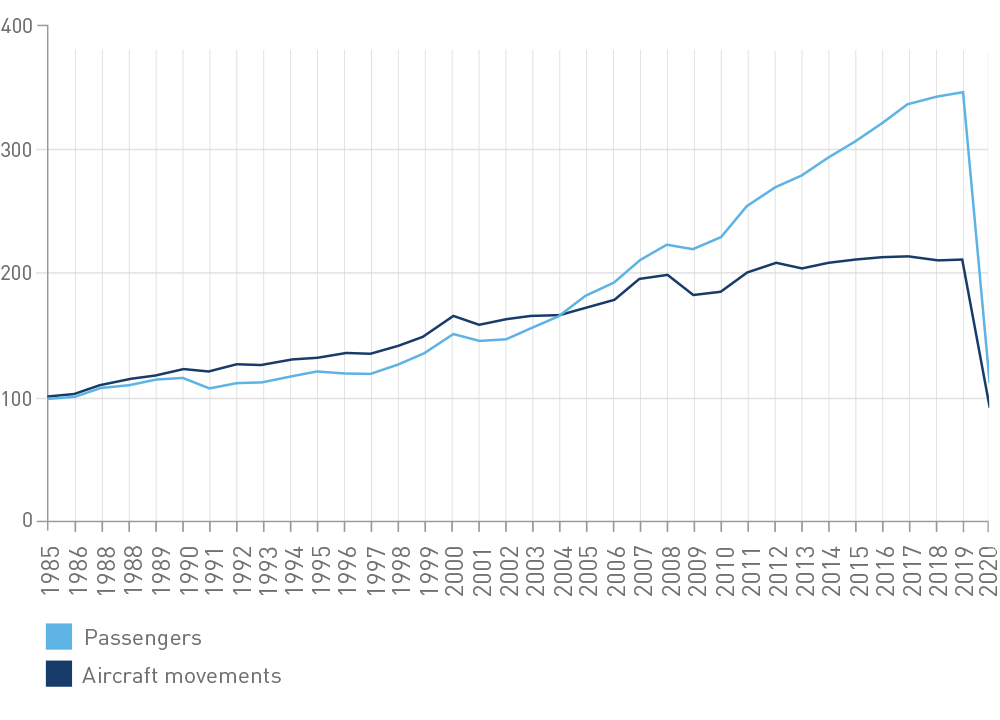

Over the course of 2020, Genève Aéroport welcomed 5,600,906 passengers i.e. 68.8% less than in 2019,due to the pandemic, which severely hindered air transport for many months (flight cancellations, border closures, entry restrictions, mandatory quarantines, etc.). Figures this low have not been recorded in several decades. In 2019, Genève Aéroport welcomed 17,926,625 passengers.

Alongside this, over the last twelve months, the total number of landings and take-offs fell by 53.6% to 86,354 movements against 186,043 movements. A year earlier, the number of aircraft movements had fallen by 0.6% from 2018. Taking into account business aviation alone, the reduction in aircraft movements in 2020 was 19.9%.

Evolution of the number of passengers and movements

-68.8%

of passengers in 2020

-53.6%

of movements in 2020

Overall traffic result

| Passengers | 2020 | 2019 | Variation 2020/2019 |

|---|---|---|---|

| Scheduled traffic* | 5,513,856 | 17,755,766 | -68.9% |

| Charter traffic* | 33,473 | 86,126 | -61.1% |

| Other commercial traffic | 37,958 | 54,818 | -30.8% |

| Total non-commercial traffic | 15,619 | 29,915 | -47.8% |

| Total overall traffic | 5,600,906 | 17,926,625 | -68.8% |

* Scheduled traffic and passenger charter

| Movements | 2020 | 2019 | Variation 2020/2019 |

|---|---|---|---|

| Passenger scheduled traffic | 51,915 | 143,303 | -63.8% |

| Passenger charter traffic | 272 | 667 | -59.2% |

| Other commercial traffic | 20,878 | 26,442 | -21% |

| Total non-commercial traffic | 13,289 | 15,631 | -15% |

| Total overall traffic | 86,354 | 186,043 | -53.6% |

During the crisis, the airport never ceased to operate, hosting medical flights, repatriation flights and cargo aircraft loaded with medical equipment.

Nevertheless, the year 2020 started with positive figures… From mid-March, air traffic fell sharply, with just a few flights by the end of March and barely 200 to 300 passengers per day in April and May.

Evolution of the number of passengers per month

All type of traffic. Passengers counted in millions.

Evolution of the number of passengers and movements

Aircraft movements: only commercial traffic (1985: index 100)

Evolution of the number of passengers by movements

Scheduled and charter, passengers only

Close dialogue with all airport stakeholders

In the sales and marketing teams, when company operations ceased, regular close contact was maintained with airlines and all companies operating at the airport. The main priority for these teams was to share the information and operational and health measures decided by the Genève Aéroport Task Force with all stakeholders, and secondly, to prepare for the resumption of activities. Objectives for some teams were to assist with, support and monitor the challenges encountered by organisations in aid, catering, fuel supply and passenger services, to anticipate possible failures and to act as a relay between the Confederation and the companies concerned, communicating support measures for the Swiss airport system. For others, the objective was to examine the conditions, destinations and frequency of rescheduled flights, developing support measures for the airport’s recovery.

Particular efforts have been made to bring back long-haul connections, despite travel restrictions. From summertime, Emirates, Etihad Airways and Ethiopian Airlines resumed several flights per week. Air Canada also returned to Geneva for a few months during the first wave of the pandemic. However, restrictive conditions in North America forced the airline to suspend its flights again from October. These intercontinental flights have made it possible to sustain a minimum of passengers, particularly expatriates wishing to return home, as well as significant freight activity for the region (see below), both for the import and export of merchandise.

For airport partners, one-off aid was provided by Genève Aéroport in April and May, with reductions on rents and specific costs linked to interrupted operations. For airlines, an aid programme in the form of temporary relief from landing fees was proposed by Genève Aéroport.

This constant monitoring required effort from all teams to assist, support and come up with solutions, as well as measure their impact. This phase was a valuable foundation for the later phases of restarting, decline and closures and, finally, recovery at the end of the year.

As a result of the Covid-19 pandemic, the development of intercontinental lines has been interrupted. The announcement of the arrival of Air Senegal did not take place in the summer of 2020. Despite this setback, Genève Aéroport's network development strategy still stands: to favour sustainable, high-quality aviation and guarantee good intercontinental connectivity. Moreover, during this phase of traffic collapse, the strength of Genève Aéroport's network of intra-European connections was proven. This network was the mainstay of the return of activity from mid-June to the end of August. With summer demand for tourist trips and family visits, overall, several Mediterranean countries have lost less traffic than average: Greece (-55%), Portugal (-58%), Turkey (-62%).

Latest generation aircraft favoured

During the crisis, several airlines favoured the use of latest generation aircraft, which are more economical in terms of operating costs. Contributing to limiting noise emissions, category 5 aircraft, which are less noisy and require less fuel (including the Bombardier CSeries, the A 320neo, the A 350 and the Boeing 787), represented 22.8% of airliner and charter movements compared to 18.7% in 2019. In 2020, the top two classes (5 and 4) represented a total of 90.3% of aircraft movements.

Distribution by class of noise

Scheduled and charter, passengers only (excluding ferry flights). Level of noise: 1 being the loudest, 5 the least noisy. Data shown in %.

«Category 5 aircraft - less noisy and less polluting - accounted for 22.8% of airliner and charter aircraft movements.»

Throughout 2020, all departure destinations suffered a sharp drop in passengers. London and Paris still hold the top two positions for the 20 most visited cities. They are followed by two Portuguese destinations, Porto and Lisbon, which recorded a drop of around 57%: significantly lower than the other major destinations. Barcelona, which was 5th in 2019, fell to 10th place, while Istanbul moved up from 15th to 11th place.

Top 20 destinations by city

| Cities | Passengers | Variation 2020/2019 |

|---|---|---|

| London | 865,883 | -65.5% |

| Paris | 324,823 | -69.3% |

| Porto | 288,784 | -57.5% |

| Lisbon | 259,053 | -58.3% |

| Amsterdam | 239,144 | -66.0% |

| Brussels | 175,029 | -71.3% |

| Zurich | 172,359 | -72.9% |

| Madrid | 164,319 | -71.5% |

| Nice | 132,942 | -65.4% |

| Barcelona | 132,607 | -79.2% |

| Istanbul | 132,058 | -64.4% |

| Francfort | 121,915 | -71.9% |

| Nantes | 98,943 | -52.1% |

| Athens | 96,419 | -54.7% |

| Rome | 91,998 | -71.5% |

| Manchester | 88,189 | -67.4% |

| Dubai | 84,394 | -72.2% |

| Bristol | 79,255 | -62.3% |

| Copenhagen | 73,572 | -66.6% |

| Bordeaux | 71,884 | -66.4% |

Results by destination

The airline easyJet remains the leader in Geneva in 2020, with a market share of 45.7% against 44.8% in 2019. Swiss achieved a market share of 13.8% compared to 14% a year earlier. British Airways keeps third place with 5.5% (5% in 2019). The rest of the Top 10 is made up of Air France (4.2%), KLM Royal Dutch Airlines (2.9%), Iberia (2.4%), TAP Portugal (2.2%), Brussels Airlines (2%), Turkish Airlines (1.7%) and Emirates (1.5%). Other companies together have a market share of 18.1%.

Market shares by airline

Data shown in %.

Scheduled traffic per airline

| Airlines | Passengers | Variation 2020/2019 |

|---|---|---|

| Aegean Airlines | 52,303 | -52.0% |

| Aer Lingus | 27,349 | -73.0% |

| Aeroflot | 61,364 | -68.0% |

| Air Algerie | 7,842 | -80.8% |

| Air Baltic | 3,767 | -86.7% |

| Air Canada | 32,902 | -76.9% |

| Air China | 5,993 | -88.6% |

| Air France | 233,643 | -68.1% |

| Air Malta | 4,043 | -51.4% |

| Air Mauritius | 7,086 | -22.3% |

| Alitalia | 60,982 | -68.2% |

| Austrian | 58,591 | -71.9% |

| Azal Azerbaijan Airlines | 401 | -92.4% |

| Belavia | 3,753 | -72.9% |

| British Airways | 301,556 | -65.9% |

| Brussels Airlines | 110,213 | -71.3% |

| Chair Airlines | 3,634 | -59.8% |

| Cyprus Airways* | 1,682 | -- |

| Easy Jet | 2,20,014 | -68.4% |

| Egyptair | 13,365 | -67.9% |

| El Al | 11,447 | -78.7% |

| Emirates | 84,394 | -72.2% |

| Ethiopian Airlines | 15,128 | -39.6% |

| Etihad Airways | 22,704 | -78.6% |

| Eurowings | 15,661 | -81.1% |

| Finnair | 29,097 | -71.4% |

| Flybe | 7,290 | -57.8% |

| Iberia | 130,766 | -67.2% |

| Jet 2 | 81,588 | -31.3% |

| Kenya Airways | 6,567 | -69.0% |

| Klm | 162,208 | -63.7% |

| Kuwait Airways | 4,060 | -81.3% |

| Lot Polish Airlines | 35,327 | -66.5% |

| Lufthansa | 49,935 | -84.4% |

| Luxair | 11,766 | -78.2% |

| Middle East Airlines | 20,014 | -70.7% |

| Norwegian | 15,279 | -68.9% |

| Pegasus | 49,698 | -50.4% |

| Qatar Airways | 26,172 | -78.2% |

| Rossiya | 3,400 | +7.0% |

| Royal Air Maroc | 19,108 | -75.0% |

| Royal Jordanian | 2,18 | -85.2% |

| Sas Scandinavian Airlines | 63,466 | -57.8% |

| Saudia | 12,916 | -82.3% |

| Swiss | 761,874 | -69.4% |

| Tap Portugal | 120,785 | -69.0% |

| Transavia Airlines | 3,600 | -55.8% |

| Transavia France | 6,282 | +122.4% |

| Tunisair | 28,659 | -65.6% |

| Turkish Airlines | 92,760 | -66.7% |

| Ukraine International | 10,646 | -81.2% |

| United Airlines | 28,438 | -85.5% |

| Vueling | 31,053 | -82.7% |

| Wizz Air | 39,171 | -54.8% |

| Total | 5,513,819 |

Distribution by alliance in 2020

Data shown in %.

Distribution outside alliance in 2020

Data shown in %.

Au-delà des compagnies aériennes membres des trois principales alliances, Genève Aéroport accueille plusieurs autres compagnies hors toute alliance, qui représentent au total 55% du trafic.

Successful negotiations for aeronautical charges

In parallel with this exceptional situation, from the start of 2020 as planned, Genève Aéroport led a new round of negotiations to set aeronautical charges for the 2021-2023 tariff period. These include passenger charges, landing charges depending on the type of aircraft, ground parking charges, environmental charges and freight charges.

This complex process, structured by a federal order and lasting for at least nine months, was interrupted for several months due to the Covid-19 crisis. It resumed in July with proposals adapted to the situation, but still retaining incentives for airlines to keep using newer generation aircraft, allowing Genève Aéroport to achieve its objectives in terms of noise (SAIP).

Following negotiations, an agreement was reached on 23 October 2020 with the airlines represented around the table, and was approved by the Board of Directors on 27 October 2020. The agreement reached between Genève Aéroport and the airlines comes into force on 1 January 2021. The passenger charge increase of CHF 4.45 will come into effect from 1 July 2021. The increase in landing charges will be 10% and an incentive programme for new generation aircraft will see reductions for airlines using planes with class 5 for noise and wide-body aircraft with class 4. This incentive will also have an impact on the charge per passenger travelling by new generation aircraft.

This tariff adjustment was essential to generate the aeronautical revenues necessary to finance the airport infrastructure. The agreement reflects a mutual understanding of each party’s needs. In addition, it strengthens Genève Aéroport's objectives for reducing noise pollution.

Decrease in freight and resilience of activity

The tonnage of air cargo handled at Genève Aéroport in 2020 was strongly affected by the health crisis, sluggish economic performance and a large part of the hold capacity on wide-body aircraft being suppressed, registered at 52,658 tonnes. This 38% drop in tonnage compared to the same period in 2019 varies from one business segment to the next. The fall was the most marked for freight transported in the airline holds (excluding integrators), recording a downturn of 58.92%, while freight by trucks saw a boom-and-bust cycle with a downturn limited to 20.37% Only express courier companies (DHL Express, FedEx/TNT and UPS) continued to perform well due to their autonomous logistics organisation, enabling an increase in traffic of 4.15% or 14,961 tonnes in 2020.

Cargo and postal traffic results

| Freight | 2020 | 2019 | Variation 2020/2019 |

|---|---|---|---|

| Scheduled traffic | 31,734 | 55,011 | -40% |

| Charter traffic | 3,061 | 994 | -67.5% |

| Aircraft air freight | 32,728 | 58,072 | -43.6% |

| Trucked air freight | 17,941 | 22,529 | -20.4% |

| Total air freight | 50,669 | 80,061 | -37.1% |

| Postal freight | 1,990 | 4,326 | -54% |

| Total air freight and post | 52,658 | 84,927 | -38% |

In this difficult situation, air freight found renewed significance in the spring, with the introduction of all-cargo flights aimed at meeting the essential needs of some of the population and of the regional economy. An airlift was therefore established between Shanghai and Geneva, where around thirty (28) wide-body aircraft filled with protective medical equipment unloaded their cargo at Genève Aéroport to supply the various hospitals in Switzerland in particular. In total, 140 million masks and protective medical equipment will have passed through Genève Aéroport. A large number of airlines helped ensure this supply, including China Eastern, Ethiopian, Emirates and Swiss, which dispatched medical equipment from China destined for Geneva University Hospitals (HUG) and those in the canton on 21 April.

Commercial space: exceptional initiatives

The year 2020 has been very unique, and so has air traffic: after two very fruitful months of activity in January and February (4% increase in turnover against 2019), the momentum collapsed in mid-March. By the end of the year, 70% of turnover for 2020 had been achieved over two and a half months.

The Covid-19 pandemic has reduced air traffic activities. In addition, three waves of business closures and restrictions were declared: on 16 March 2020 by the Federal Council, and 1 November and 23 December 2020 by the canton of Geneva. These restrictions strongly affected the life of commercial businesses, shops and restaurants in particular.

This extraordinary situation has given rise to exceptional initiatives. It has led to previously unimaginable actions, such as flexible opening times and working hours, temporary closures in the event of low traffic, changes in passenger flows, an option to purchase at the counter in times of acute restrictions, the closing of parts of the retail area and gathering around the central square to create a space where passengers and businesses could meet. While the overall volume has fallen sharply, the cost of the average basket or ticket has remained stable.

The other major commitment requiring effort from all teams was to support commercial businesses in overcoming daily challenges, implementing closing and reopening operations, and implementing health and social distancing measures. With a member of the commercial team on the Covid Task Force, this allowed for rapid communication of information and measures, as well as the participation of all those involved in the operations.

In addition, to relieve financial costs for commercial businesses, ongoing contact throughout the year led to several measures: in particular, suppressing the minimum guaranteed charge threshold, reducing costs during the first wave of closure, granting rate reductions on charges using various methods, and the ongoing provision of traffic forecast tables. In addition, Genève Aéroport contributed to the development of the cantonal assistance plan for businesses in the airport area as approved by the Grand Council of Geneva in November.

Rediscover the freedom to travel

Despite the upheavals of 2020, marketing teams have maintained the publication schedule, with two issues of TakeOff per year, as well as several newsletters in both paper and digital form intended for airlines, the cargo industry and the general public.

When lockdown ended in June, Genève Aéroport set out to revive tourist demand through a poster campaign in French-speaking Switzerland. The campaign slogan was « Rediscover the freedom to travel », a very natural invitation after several months of lockdown. The main message was to inspire people to go on holiday, especially during the summer.

Over the summer, demand did pick up, especially for tourism and family visits. Among the most visited countries were Portugal, France, Greece, Spain and Italy. Surveys carried out by Genève Aéroport among the population have shown a clear desire to get back on a plane.

In the meantime, the situation has become even more complex. Border closures and the imposition of quarantines, often announced at the last minute, have shattered this momentum.

Despite this situation, Genève Aéroport has decided to keep up its efforts with the public and travel industry. To this end, a new promotional campaign was launched in the autumn, with the following phrase: « Rediscover the desire to travel ». The intention was to maintain a state of mind and motivate people wanting to travel, as well as expressing Genève Aéroport's support for all those involved in the tourism sector.

High passenger satisfaction levels

For the past fifteen years, measures have been taken throughout the year to better understand airport users, assess the quality of services and measure passenger satisfaction. Except during period of partial lockdown, these measures continued in 2020, adapting sampling plans and methods for collecting information. For example, face-to-face interviews were replaced by tablet questionnaires that passengers completed themselves. Nearly 3,000 passengers gave their time to share their opinion on Genève Aéroport's services, and nearly 3,000 internet users answered questions online.

The smiley boxes, which were frequently disinfected by the airport cleaning teams, were used non-stop in 2020 and more than 1.2 million votes were recorded. Feedback revealed that the use of toilets had increased, in line with the increased need for passengers and staff to wash and sanitise their hands.

All measures have led to great confidence among passengers in the services and measures put in place against Covid-19. Satisfaction rose to levels that have not been reached in the time that surveys have been carried out at Genève Aéroport. The main reasons for this clear improvement are a feeling of safety, courtesy shown by employees, particularly short waiting times and greater space available in the terminal due to low passenger numbers. Excellent service provided by the staff on duty has been particularly appreciated as a key element in ensuring the best possible experience for passengers.

As a result of always listening to passengers, on 8 February 2021, Genève Aéroport received « The Voice of the Customer » award, issued by the ACI (Airport Council International). Implemented in 2020, this initiative, rewards airports that have continued to carry out ASQ (Airport Service Quality) surveys despite the pandemic.

Launch of gva.boutique

Launched in July 2020, gva.boutique has won over many collectors and enthusiasts of items exclusive to Genève Aéroport. More than 230 orders have been shipped to Switzerland and France, with a total of more than 400 items sold! Top of the sales is the Genève Aéroport watch, in a limited edition and available exclusively on this platform. The 100 years book, telling the incredible stories of Genève Aéroport, is the second best-selling product. In light of this success, new items will be listed over the coming months.

As part of its social responsibility strategy, Genève Aéroport has renewed its collaboration with Fondation Foyer-Handicap for the packaging and shipping of its orders.