Go to Summary

Go to Summary

Strong recovery of traffic

Evolution of the number of passengers and movements in 2022

+137.8%

of passengers

+64.4%

of movements

In 2022 Genève Aéroport welcomed 14,085,280 passengers, a rise of 137.8% on 2021 (5,923,035). This strong rebound marked a more than doubling of footfall over the year, but was still 21.4% fewer passengers than in 2019, the year before the pandemic. By way of reminder, Genève Aéroport welcomed 17,920,625 passengers in 2019. Total traffic (scheduled, charters, commercial and non-commercial) rose 64.4% over 2021 to 163,168 movements. Despite the strong increase in scheduled and charter traffic and major business aviation activity, the number of movements in 2022 was 12.3% below the 186,043 movements seen in 2019. Air freight activity rose 18.67% to 70,566 tonnes handled, supported by the return of capacity on heavy cargo aircraft.

Overall traffic result

| Passengers overall traffic | 2022 | 2021 | 2020 | Variation 2022/2020 | Variation 2022/2020 |

|---|---|---|---|---|---|

| Other commercial traffic | 60,795 | 46,017 | 38,004 | 31.89% | 59.97% |

| Total non-commercial traffic | 27,196 | 22,595 | 15,619 | 20.36% | 74.12% |

| Charter traffic pax | 35,542 | 3,926 | 33,473 | 805.30% | 6.18% |

| Scheduled traffic pax | 13,961,747 | 5,850,497 | 5,513,798 | 138.65% | 153.21% |

| Total pax overall traffic | 14,085,280 | 5,923,035 | 5,600,894 | 137.81% | 151.48% |

| Movements overall traffic | 2022 | 2021 | 2020 | Variation 2022/2021 | Variation 2022/2020 |

|---|---|---|---|---|---|

| Other commercial traffic | 31,960 | 27,406 | 20,879 | 16.61% | 53.07% |

| Total non-commercial traffic | 16,066 | 15,870 | 13,289 | 1.24% | 20.90% |

| Passenger charter traffic | 290 | 88 | 272 | 229.55% | 6.62% |

| Passenger scheduled traffic | 114,852 | 55,885 | 51,914 | 105.52% | 121.24% |

| Total movements overall traffic | 163,168 | 99,249 | 86,354 | 64.40% | 88.95% |

Evolution of the number of passengers per month

All types of traffic. Passengers in million.

An important recovery

After a very fragile beginning of the year because of the Omicron virus, which had hit traffic sharply in November and December 2021, the gradual removal of sanitary measures for UK citizens in mid-February allowed the winter season to get off to a delayed but vigorous start. In March 2022 Genève Aéroport saw the number of passengers heading for the ski slopes in Switzerland and nearby France rocket.

The sharp pick-up in passenger numbers at a time when the headcount at platform partners was still constrained by the economic crisis caused some difficulties. Learning from these sometimes chaotic experiences, measures were put in place to move into the summer season, primarily by training and strengthening teams.

And the forecasts turned out to be right! The healthy appetite for travelling was sustained throughout the Easter holidays and stepped up again over the summer. For the year as a whole 2022 saw passenger traffic almost on the level forecast in autumn 2021, i.e. down 21.4% from 2019. Genève Aéroport and all the platform partners showed themselves capable of coping remarkably well with a sustained recovery and providing a full service to customers.

There are several factors behind the strong growth in passenger traffic in Geneva in 2022 once virtually all barriers to travelling were lifted. First, a strong desire to travel, visit parents and friends and take holidays elsewhere. The need for mobility is particularly high in Geneva because of the significance of VFR (visiting friends and relatives) traffic as a consequence of the international nature of the population in the area served by Genève Aéroport. Second, the recovery was sustained by the key economic importance of Geneva and its region, where a more significant portion of the population is affluent than in other European cities.

Evolution of the number of passengers by movement

Scheduled and charter, passengers only

Evolution of the number of passengers and movements

Aircraft movements: only commercial traffic (1985 : index 100)

High capacity utilisation

Another important factor in 2022 was the high level of capacity utilisation, and hence a high number of passengers per flight. This saw a significant change. From an average number of passengers per flight of 112 in 2016 and 118 in 2017, the number rose to 123 in 2018 and 124 in 2019. It then fell back to 106 in 2020 and 105 in 2021 before recovering to 122 passengers per scheduled and charter flight in 2022.

Every year the number of stage 5 aircraft (the quietest ones) at Geneva rises. The share of scheduled and charter flights carried out by stage 5 aircraft rose from 22.25% in 2021 to 24.95% in 2022. The figure in 2019 was 18.75%. The top two categories together (stages 4 and 5) made up 90.98% of movements last year.

Distribution by class of noise

Scheduled and charter, passengers only

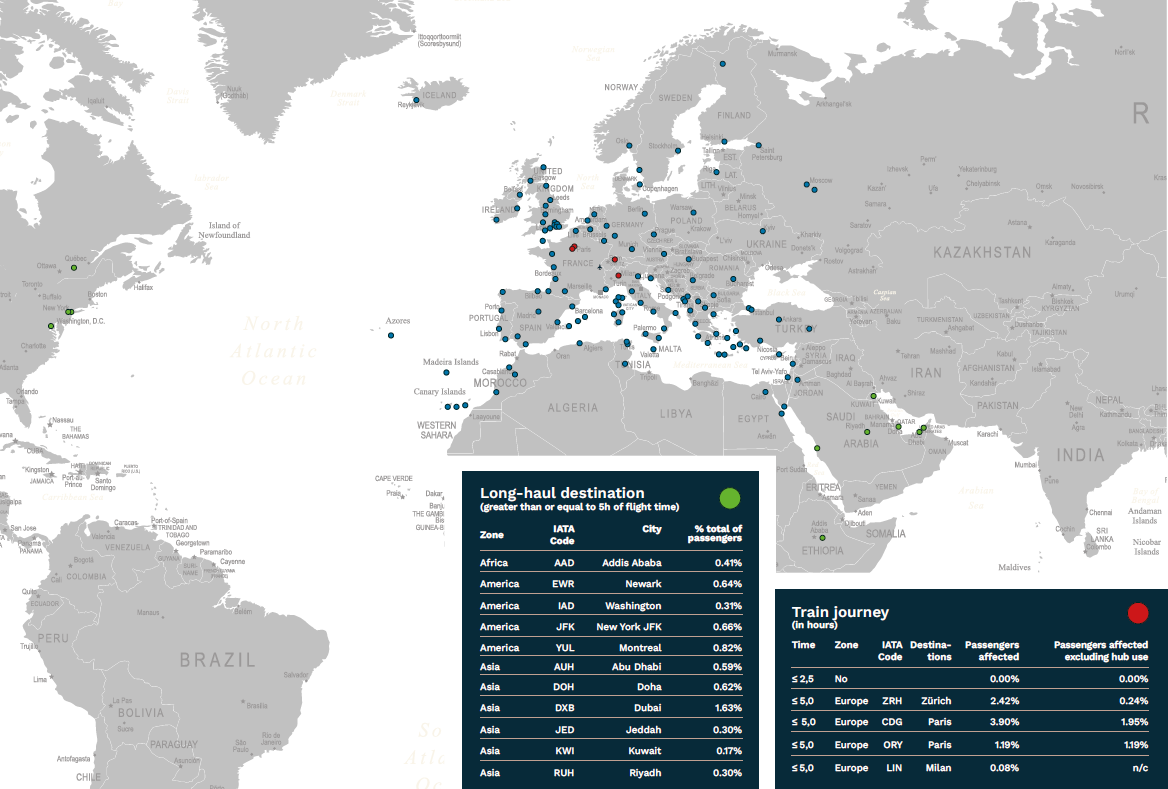

Long-haul network fully restored

Apart from the major recovery in passenger volumes, 2022 also saw the pre-crisis long-haul network from Genève Aéroport almost fully restored. With the exception of Air China, currently scheduled to return in February 2023, all primary destinations in North America, the Middle East and sub-Saharan Africa have been restored and flight frequencies are back to the level of before the pandemic. In some cases they are even higher than they were. Ethiopian Airlines has added a fourth weekly flight to meet the demand from diplomats and African communities.

The network has been expanded by the announcement that US airline Delta will be arriving in spring 2023 with a flight to New York, underscoring just how attractive Geneva and its catchment area are. Passenger traffic to and from non-European airports reached 10.92% in 2022.

Market shares by airline

Scheduled traffic

Distribution by alliance

Distribution outside alliance

In addition to airlines of the three main alliances, Genève Aéroport hosts several other non-alliance companies, which represent a total of 58.36% of the traffic.

Genève Aéroport served 139 destinations in 2021; this rose to 146 in 2022. The number of airlines operating to and from Geneva went up from 48 in 2021 to 52 in 2022. Newcomers in 2022 included flights to Enfidha-Hammamet, Corfu and Izmir in summer, and Venice, Tenerife, Funchal (Madeira) and Kittilä (Lapland) in the winter season.

The leader in terms of market share remains easyJet at 49.6%. Then come SWISS at 11.5% and British Airways at 4.7%. The top 10 in 2022 also included Air France (3.9%), Iberia (2.9%), KLM Royal Dutch Airlines (2.3%), TAP Portugal (2.1%), Turkish Airlines (2%), Lufthansa (1.9%) and Emirates (1.6%).

Among the most popular cities, London, Paris, Porto and Amsterdam occupy four of the top five rankings, as before the pandemic. Lisbon was number three in 2021 and is now one of the five busiest destinations from and to Geneva. Barcelona has slipped to seventh place, behind Madrid. The top non-European destination in 2022 was Dubai, ranked number 15.

TOP 20 DESTINATIONS BY CITY

| Villes | Passagers 2022 | Passagers 2021 | Variation 2022/2021 |

|---|---|---|---|

| London | 1,820,698 | 345,646 | +426.8% |

| Paris | 709,864 | 292,082 | +143% |

| Porto | 645,065 | 374,240 | +72.4% |

| Lisbon | 623,570 | 331,459 | +88.1% |

| Amsterdam | 525,177 | 241,112 | +117.8% |

| Madrid | 518,213 | 266,042 | +94.8% |

| Barcelona | 464,387 | 178,663 | +159.9% |

| Brussels | 427,308 | 177,661 | +140.5% |

| Nice | 379,544 | 172,829 | +119.6% |

| Istanbul | 363,272 | 223,078 | +62.8% |

| Zurich | 337,936 | 186,205 | +81.5% |

| Frankfurt | 274,368 | 137,259 | +99.9% |

| Manchester | 238,614 | 41,002 | +482% |

| Roma | 228,720 | 92,225 | +148% |

| Dubai | 228,002 | 121,228 | +88.1% |

| Athens | 213,284 | 120,864 | +76.5% |

| Bordeaux | 206,759 | 107,796 | +91.8% |

| Pristina | 206,070 | 138,353 | +48.9% |

| Nantes | 192,128 | 101,149 | +89.9% |

| New York | 185,716 | 13,304 | +1,295.9% |

Scheduled traffic per airline

| Compagnies | PAX 2022 | PAX 2021 | PAX 2020 | Variation 2022/2021 | Variation 2022/2020 |

|---|---|---|---|---|---|

| Aegean airlines | 107,092 | 75,258 | 52,292 | +42.3% | +104.8% |

| Aer lingus | 94,083 | 8,979 | 27,349 | +947.8% | +244.0% |

| Aeroflot | 13,161 | 71,430 | 61,361 | -81.6% | -78.6% |

| Air algerie | 29,148 | 0 | 7,842 | +271.7% | |

| Air arabia maroc | 16,083 | 7,507 | 0 | +114.2% | |

| Air baltic | 3,888 | 1,039 | 3,767 | +274.2% | +3.2% |

| Air canada | 115,159 | 28,710 | 32,902 | +301.1% | +250.0% |

| Air france | 545,567 | 222,723 | 233,643 | +145.0% | +133.5% |

| Air malta | 5,557 | 1,815 | 4,043 | +206.2% | +37.4% |

| Aurigny | 241 | 0 | 0 | ||

| Austrian | 120,601 | 6,476 | 58,591 | +78.7% | +105.8% |

| British airways | 650,330 | 151,157 | 301,556 | +330.2% | +115.7% |

| Brussels airlines | 188,630 | 113,786 | 110,213 | +65.8% | +71.2% |

| Easy jet | 6,919,838 | 2,843,352 | 2,519,967 | +143.4% | +174.6% |

| Egyptair | 38,651 | 19,934 | 13,365 | +93.9% | +189.2% |

| El al | 33,088 | 2,925 | 11,447 | +1 031.2% | +189.1% |

| Emirates | 228,002 | 121,228 | 84,394 | +88.1% | +170.2% |

| Ethiopian airlines | 75,444 | 44,811 | 15,128 | +68.4% | +398.7% |

| Etihad airways | 81,290 | 24,702 | 22,704 | +229.1% | +258.0% |

| Eurowings | 37,391 | 12,781 | 15,661 | +192.6% | +138.8% |

| Finnair | 70,662 | 16,486 | 29,097 | +328.6% | +142.8% |

| Flybe | 201 | 0 | 7,290 | -97.2% | |

| Flyr | 4,203 | 0 | 0 | ||

| Iberia | 402,892 | 228,502 | 130,766 | +76.3% | +208.1% |

| Icelandair | 2,2374 | 5,366 | 0 | +317.0% | |

| Ita airways | 101,766 | 51,278 | 60,982 | +98.5% | +66.9% |

| Jet 2 | 103,656 | 2,475 | 81,588 | +4 088.1% | +27.0% |

| KLM royal dutch airlines | 317,794 | 179,162 | 162,208 | +77.4% | +95.9% |

| Kuwait airways | 23,884 | 7,909 | 4,060 | +202.0% | +488.3% |

| LOT polish airlines | 99,142 | 45,568 | 35,327 | +117.6% | +180.6% |

| Lufthansa | 266,545 | 95,951 | 49,935 | +177.8% | +433.8% |

| Luxair | 30,791 | 8,817 | 11,766 | +249.2% | +161.7% |

| MEA middle east airlines | 51,548 | 24,483 | 20,014 | +110.5% | +157.6% |

| Norwegian | 28,355 | 798 | 15,279 | +3 453.3% | +85.6% |

| Nouvelair tunisie | 11,100 | 2'978 | 0 | +272.7% | |

| Pegasus | 113,186 | 83,919 | 49,698 | +34.9% | +127.7% |

| Qatar airways | 88,086 | 0 | 26,172 | +236.6% | |

| Rossiya | 1,649 | 8,636 | 3,400 | -80.9% | -51.5% |

| Royal air maroc | 70,197 | 43,508 | 19,108 | +61.3% | +267.4% |

| Royal jordanian | 10,654 | 0 | 2,118 | +403.0% | |

| SAS scandinavian airlines | 85,629 | 22'241 | 63,466 | +285.0% | +34.9% |

| saudia | 83,009 | 26,123 | 12,916 | +217.8% | +542.7% |

| Sun express | 34,035 | 10,157 | 0 | +235.1% | |

| Swiss | 1,604,912 | 70,2685 | 761,874 | +128.4% | +110.7% |

| TAP portugal | 294,485 | 133,800 | 120,785 | +120.1% | +143.8% |

| Transavia airlines | 3,310 | 90 | 3,600 | +3 577.8% | -8.1% |

| Tunisair | 73,950 | 40,699 | 28,659 | +81.7% | +158.0% |

| Turkish airlines | 275,900 | 156,719 | 92,760 | +76.0% | +197.4% |

| Ukraine international | 4,226 | 11,624 | 10,646 | -63.6% | -60.3% |

| United airlines | 135,722 | 12,523 | 28,438 | +983.8% | +377.3% |

| Vueling | 175,662 | 58,550 | 31,053 | +200.0% | +465.7% |

| Wizz air | 68,979 | 41,045 | 39,171 | +68.1% | +76.1% |

| Total | 13,961,748 |

War in Ukraine and stormy skies in Europe

The war in Ukraine and the geopolitical situation in that part of Europe had a real but moderate impact on passenger and flight volumes, with direct connections to Moscow and Kyiv cancelled and weaker passenger volumes to neighbouring countries. Before the war there were four flights per week between Kyiv and Geneva and about ten flights per week to Russia (SWISS and Aeroflot).

The conflict has had a particularly strong impact on air travel across Europe, with flight paths disrupted by military operations, causing significant extra work for the air traffic control centre in Karlsruhe (Germany).

One side-effect of the war, and especially the European sanctions imposed on Russia, was that an Aeroflot Airbus did not return to Moscow before European airspace closed to it. It has remained parked on the tarmac at Geneva since 27 February 2022.

On the positive side, Genève Aéroport saw clients from the Persian Gulf return in significant numbers and US clients returned to Europe as the dollar strengthened against the euro.

There were other challenges in the skies in 2022 that affected traffic and many European airports, quite apart from the geopolitical situation associated with the war in Ukraine. The change of air traffic control equipment, especially the integration of TopSky and 4-Flight systems, caused considerable disruption at control centres in Lisbon, Rheims and Marseille.

Development and connectivity

The Salon Envol was suspended during the pandemic, but in 2022 metamorphosised into a new event running over three days off the airport site. Held in the Balexert shopping centre in Geneva, this was a great success; twenty or so exhibitors (airlines, tour operators, tourism offices) and special guest Skyguide worked to attract and recruit new employees. Equally, with a view to raising the quality of connectivity, especially in terms of long-haul destinations, the teams from Genève Aéroport travelled to major professional events abroad as well as regional shows in Switzerland and France.

In 2022 Genève Aéroport launched a large-scale study of business travel by multinationals, international organisations and specialist associations in the region. This revealed a recovery in business travel in the second half, a limited share of trips replaced by video conferences (20%) and confirmation of the importance of travelling to meet clients in person, develop new prospects and take part in major conferences. The study also highlighted which long-haul destinations were seen as particularly desirable and favoured by companies in the region; Singapore was the clear winner, followed by Tokyo and Sao Paulo. In addition, it showed that the airport and the new East Wing enjoy a good image among these clients.

Destinations

Scheduled traffic by region and by country

Long-haul destinations and train journeys

Passenger satisfaction score just under 4

After the pandemic interruption, Genève Aéroport has resumed its quarterly satisfaction surveys, including the ASQ (Airport Service Quality) ranking. The rating scale for the ASQ, which is managed by the ACI and covers more than 280 airports, ranges from 1 (poor) to 5 (excellent).

Following very high satisfaction scores in 2020 and 2021, the ratings recorded in 2022 as traffic recovered approached those seen in 2019. Overall satisfaction was 3.94 in the fourth quarter of 2022, the same as in the comparable period in 2019.

These results confirm that the most important factor influencing satisfaction at Genève Aéroport is the number of passengers. This number affects the space available to move around in the terminal, check-in waiting times, the number of seats in the boarding lounge, etc. The lack of space in T1, a terminal built in 1968 for around 10 million passengers, is a constraint in Geneva that is reflected in declining scores at very busy periods. On less busy days, satisfaction is distinctly higher. Ultimately the CAP 2030 project will solve this challenge.

The study showed the very positive impact the East Wing has had on overall customer satisfaction. Also worth noting is the quality of service provided by airport employees; the figures for satisfaction with them are among the highest of all the criteria rated.

Importance of business aviation

Business aviation remains important because of its economic significance and the clients it serves. Its intrinsic qualities – the ability to get to business destinations quickly with flexible timetables – remain a key factor for specific clients. Business aviation accounted for one-fifth of aircraft movements in 2022. The sector rode the wave of the pandemic, but still saw a further 16% growth in movements in 2022.

Overall, general and business aviation including commercial flights (operated by private aviation companies) and non-commercial (private) flights, military flights and training flights accounted for 48,026 movements in 2022, compared to 43,277 in 2021.

Air freight continues to grow

Air freight handled at Genève Aéroport continued to grow in 2022 (up 18.67% from 2021) and reached 70,566 tonnes, driven by two main factors: the return of capacity on heavy cargo aircraft following the almost complete restoration of the long-haul network and the overall economic picture.

Initially, air freight activity benefited from a return to the pre-pandemic level of hold capacity, consolidating the positive trend that started in late-2021. This trend was gradually overshadowed by negative geopolitical events and the worsening environment for international business flows. Ultimately, total tonnage of air and lorry freight processed at Genève Aéroport was down 16.9% on 2019, the year before the pandemic.

The three airlines with the largest market share are Emirates (21.95%), Etihad (13.60%) and SWISS (12.35%), followed by Air Canada (9.36%) and United (7.86%). Of the integrated operators, DHL Express dominates the segment at 83.59%, followed by UPS (8.49%) and FedEx (7.92%).

Postal freight also recovered: the volume handled was 2,048 tonnes (up 49.82% on 2021).

The share of traffic loaded in holds rose to 68.69% (from 65.23% in 2021); lorry freight transported by air companies accounted for 31.31%.

Cargo and postal traffic results

| Freight | 2022 | 2021 | 2020 | Variation 2022/2021 | Variation 2022/2020 |

|---|---|---|---|---|---|

| Scheduled traffic | 46,834 | 37,180 | 31,734 | +23.87% | +47.58% |

| Charter traffic | 235 | 114 | 994 | +105.16% | -76.39% |

| Aircraft air freight | 47,069 | 37,924 | 32,728 | +24.11% | +43.82% |

| Trucked air freight | 21,449 | 20,170 | 17,941 | +6.35% | +19.56% |

| Total air freight | 68,518 | 58,095 | 50,669 | +17.94% | +35.23% |

| Postal freight | 2,048 | 1,367 | 1,990 | +49.82% | +2.91% |

| Total air and postal freight | 70,566 | 59,462 | 52,659 | +18.67% | +34.01% |

Concessions for freight handling agents and security tender

In 2022 Genève Aéroport launched the process of going out to tender for freight handling activities. The companies that will be awarded the new concession will be selected in the first half of 2023.

The other tender started last year was for security services, one of the largest sub-contractor agreements signed by Genève Aéroport. The decision will be taken in the first quarter of 2023 and come into effect on 1 November 2023.

Commitment against night flights

In line with the commitments given under the PSIA, Genève Aéroport has for many years worked to reduce noise nuisance, especially at night. Flights by airlines or charter companies after 10 pm, whether scheduled or not, fell sharply in 2020 and 2021 as air traffic collapsed, but are now rising again; however they were still 7.2% lower in 2022 than 2019 (8,913 movements compared to 9,600).

Even though interruptions caused by technical, social and political factors presented major obstacles to air traffic in 2022 and caused many delays, the number of flights after 10 pm was kept below the 2019 level.

Movements between 10 pm and 6 am in 2022, adding together all categories including medical flights, came to 9,261 or 5.68% of total movements (10,037 or 5.39% in 2019).

Night movements vs. total movements

All traffic

In addition to the daily efforts made by all platform partners to limit take-offs and landings after 10 pm as far as possible, once the file for the Sectoral Plan for Aviation Infrastructure (PSIA) submitted by the airport in 2019 and adopted by the Federal Department of the Environment, Transport, Energy and Communications (DETEC) on 15 November 2022 comes into force Genève Aéroport will be able to take further action to reduce noise nuisance. Specifically, the new operating regulations introduce an innovative system of quotas proposed by Genève Aéroport to limit take-offs scheduled before 10 pm but delayed beyond that time. The system specifies progressive penalties to act as a deterrent if the quotas are exceeded.

The new dynamics of trade

The first quarter of 2022 saw all retail outlets reopen.

To keep up the momentum, many shops and restaurants have started renovating or expanding and several new chains have appeared. A dozen firms carried out works in 2022 to adapt to customers’ new needs.

Despite the interruptions for outlets carrying out work, a strong trend emerged after the pandemic years of 2020 and 2021. Total revenue (retail, catering, car hire, publicity, etc.) rose 139% over 2021, with particularly strong growth in the airside shops after security checks. Total revenue is still 20.9% down on 2019, in line with air traffic (down 21.5%).

Average spend per passenger in stores, catering facilities and duty free shops was up 4.5% over 2019, the year before the pandemic, indicating a renewed appetite for consumption and justifying a business model based to a significant extent on non-flight commercial revenue. Russian and Chinese customers were absent in 2022 because of the geopolitical situation, but consumption was particularly high among Swiss and North American travellers.

A design change was made: by removing a ventilation duct on the west side of Terminal 1 known as the pencil it was possible to provide more space for easyJet to manage its passengers checking in, for people hiring cars on the arrivals level and for those eating in the food court on the floor above.

Publicity was used to draw attention to the relaunch of the retail offering in 2022. Two campaigns were organised, one in summer and one at Christmas, as well as a solidarity campaign with the shops to support the charity Theodora. This is a foundation set up to bring smiles and moments of escape to children in hospital or with a handicap. Inviting passengers to take the time to write a post card to the children was a great success.

Various projects were started or tested to keep up with new consumer trends. These included, for example, a shop and collect concept for duty free, orders for meals delivered to the gate, etc. Commercial proposals were submitted at the end of 2022 based on data for e-commerce clients at Genève Aéroport.

New record for e-commerce

Always seeking to meet passenger needs, Genève Aéroport continued to work on plans to develop e-commerce and e-services, most notably by launching the Priority Lane subscription for regular travellers in 2022. Sales of online services in 2022 reached a record CHF 1.9 million.